Budget 2019: opportunity for strong Carbon Tax should not be wasted

October 5th, 2018

The October budget season is upon us, and as always, a number of proposals are aired in the media – kites flown in political speak.

One that has been consistently flown high over the past few months has been the rise in taxes on carbon, with little or no negative reaction.

It has been noted in many of these briefs that we will protect the vulnerable and use the taxes for decarbonisation of our economy.

From economists supporting the tax to the Citizens’ Assembly recommendations and the impending eye-watering fines from Europe, a carbon tax has been broadly welcomed.

Climate economist Joseph Curtin supports calls for higher carbon tax Photo: Niall Sargent

How much and when?

The opportunity now for the government is that a new (or rising tax) is now politically, economically and societally accepted as a smart thing to do. The only question that remains is how much and when.

At a recent Joint Oireachtas Committee meeting, the chair of the State’s climate advisory body Professor John Fitzgerald said that a €30 carbon tax would be an “essential component” of this budget as unless we get the price of carbon right, we “are going nowhere”.

Many others are calling for a sharp rise in the carbon tax to €70 a tonne. This level of taxation is needed, however, the impact in one year may be too significant for many.

Others are calling for a tax and dividend where the carbon taxes are returned to each citizen on an equal basis. One thing for sure is that the cabinet knows is that the tax needs to rise and they want to ensure it does as little political damage as possible.

A €70 carbon tax would work politically if it accompanied something really innovative like a carbon dividend. Knowing how challenging this is to do, it is highly unlikely that it will be completed as part of the 2019 fiscal framework.

A more moderate tax rise will work politically if it is linked in the right way to the right spending or tax cut measures. Either way, whether it is €10 or €20 now, it should be signalled that carbon pricing will rise to a minimum of €100 per tonne by 2022 and €200 by 2030.

All citizens can take this clear signal to encourage them to invest in low carbon technologies. So what are the options for fairly returning a carbon tax to citizens, while also maximising benefits from the tax?

smoke from chimneys. Photo: NUI Galway

Carbon tax option

The first option is to reduce taxes where they harm the productivity of the economy, the most likely candidate being income taxes.

This is good from an economics point of view and good for the squeezed middle but does not help the lower income bracket who typically spends a much higher percentage of their income on energy, and have a lower chance of avoiding energy taxes through behavioural change.

A second option is to increase fuel allowance – which applies to a quarter of our homes – to negate the impact of a carbon while still providing an incentive for carbon tax avoidance through behaviour. Note that all these homes are entitled to a free energy upgrade under the warmer homes scheme.

A third option is the funding of subsidies for low carbon investments. Just as the housing crisis will only be solved with building homes, the climate and carbon crisis will only be solved with increased investment in retrofitting and low carbon transport.

There a number of choices here and they should all be considered including cycling and public transport infrastructure; home and public building retrofitting, a decrease in VAT on renewable and efficiency technologies, tax breaks for investment in citizen energy schemes and lower purchase costs for electric vehicles.

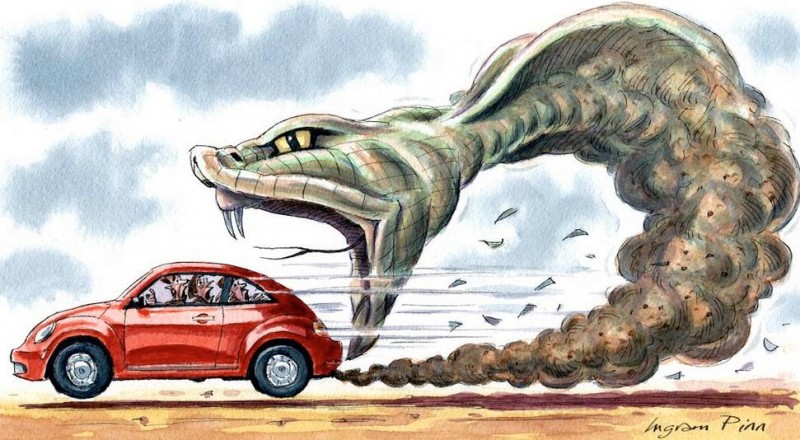

Other possible tax tweets to future-proof our citizens’ investment decisions include changing VRT rates to encourage lower emissions and smaller cars. An adjustment in VRT rates will incentivise better purchases and, combined with carbon tax rises, will ensure that SUVs are priced out fo the market.

Whichever option the State takes, one choice is clear. The economists, the environmentalists and the climate experts are all clearly calling for a steep rise in the carbon tax, and looming European fines are a big stick.

The big question is will politics allow the Government to present the bitter pill of a carbon tax in a way that it can be swallowed without society choking on it.

Paul is the Chief Executive Officer of Tipperary Energy Agency. He has been with the agency since 2006 and Chief Executive since 2012. He is involved with both renewable energy (wind and bio-energy) and energy efficiency projects. Last year, he spoke at the Citizens’ Assembly on climate change and is a strong advocate of greater action on the reduction in the use of fossil fuels