Government yet to carry out fuel poverty review as carbon tax increase looms

September 26th, 2019

Members of the climate action committee have expressed frustration at the Government’s failure to conduct a fuel poverty review as recommended prior to an increase in the carbon tax.

In its landmark report released in March, the committee called on the State to complete a detailed review into fuel poverty and impacts from a carbon tax hike. The Departments of Climate Action (DCCAE) and Finance were tasked with completing the review by June.

During a hearing of the committee yesterday, however, it was revealed that the departments have failed to carry out such a review, much to the chagrin of People Before Profit’s (PBP) Brid Smith.

Ms Smith, who tabled several parliamentary questions during the summer seeking an update on the review, said that the committee worked “long and hard hours to get agreement” on this issue. Any increase in carbon tax – currently set at €20 per tonne – was “contingent on this review”, she said.

DCCAE’s Matt Collins told the Committee that enough material was already available from a 2016 review carried out by a consultancy firm for the Department and from a recent Economic and Social Research Institute (ESRI) study that used similar metrics to the 2016 study.

He added that the Central Statistics Office (CSO) is also crunching the numbers on fuel poverty and is “best placed to inform us and use their expertise to inform policy development”.

Ms Smith was clear, however, that the recommendation was for a Government review, adding that the departments could have used ESRI and CSO data to inform their own review but “utterly refused to do” so.

Increase in the carbon tax was a major sore spot during Committee deliberations. Sinn Fein and PBP both voted against approval of the committee report based on their objection to the carbon tax proposals.

The Committee recommended that the price should increase to at least €80 per tonne by 2030 in line with advice from the Climate Change Advisory Council (CCAC). This position was subsequently adopted by the Government in its new climate action plan.

Falling at the first hurdle

Fianna Fail’s Jack Chambers also expressed his frustration at the lack of any progress with a cross-departmental review, asking departmental representatives how many times they have met to discuss the review.

Gerry Kenny from the Department of Finance said that, while the issue has come up at meetings with DCCAE regarding the climate action plan, no specific meetings have been held to date on the fuel poverty review.

“If at the first port of call [on the review] we are failing, how do you expect the public to support an increase in the [carbon] tax come budget day,” Mr Chambers asked.

If key recommendations are “collapsing on day one”, he said, it doesn’t fit well with some of the recent “high-principled rhetoric” from the Government on the issue.

Ms Smith also raised concern at the lack of progress on another recommendation that asked the Department of Finance to examine any potential revenue windfall from a carbon tax on the profits of companies from the fossil fuel industry.

Mr Kenny said that he is unaware as to “what is being done, if anything, on that recommendation”. He added that such companies are already subject to corporation tax.

Recycling the tax

The ESRI’s Dr Muireann Lynch told the committee that targeting general poverty, combined with recycling revenue from the carbon tax to citizens, would best alleviate the impacts of an increase in the tax.

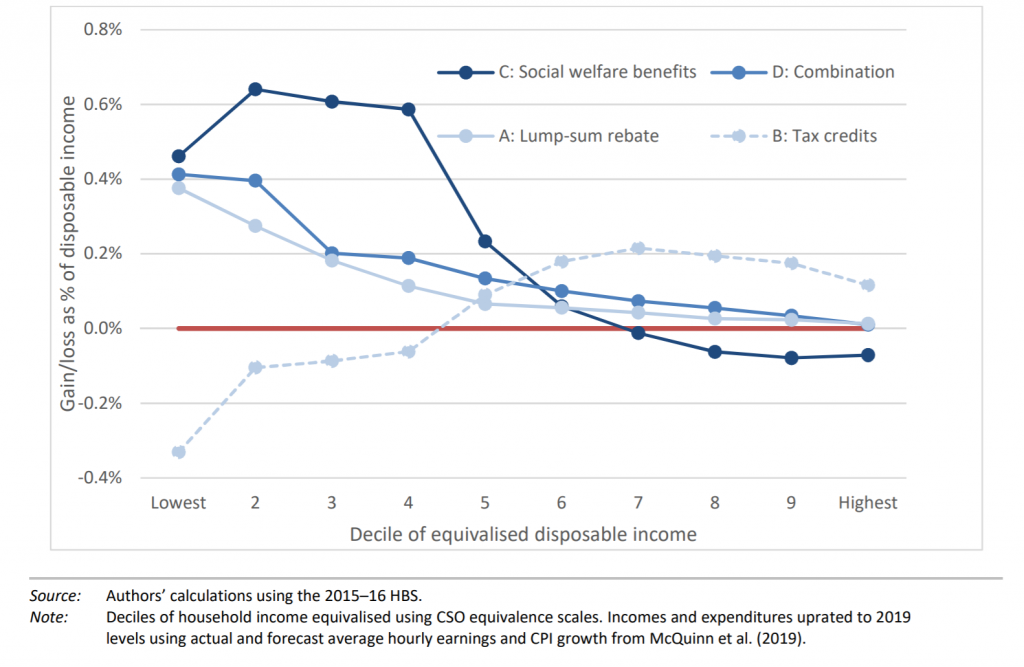

The institute has examined four potential fee and dividend models, three of which would best alleviate against impacts on low-income households, namely a cheque in the post, an increase in social welfare benefits, and a combined increase in tax credits and welfare benefits. The latter is seen as the best model.

The Government looks likely, however, to rule out a ‘fee and dividend’ system. Last week, the Taoiseach said that revenue raised from future increases in the tax will be ring-fenced for climate action such as retrofitting schemes and to fund a just transition away from fossil fuel use.

Dr Tricia Keilthy from the Society of St Vincent de Paul told the committee that the charity would like to see action to combat energy poverty prior to any carbon tax increase.

“Energy poverty remains an issue for a large volume of households,” she said, pointing out that the charity spent €4m last year alone to help low-income families with their fuel and utility costs.

Increasing the fuel allowance alone, she said, will “not be enough” to counter the increase in the carbon tax, with family also under pressure from rising energy prices and cost of living expenses more generally.

If the tax increases prior to action on energy poverty, Dr Keilthy said that the charity favours a system where revenue is recycled via maximising social welfare rates and increasing tax credits for lower-income families.

Green Party leader Eamon Ryan questioned the absence of a dividend model in a recent Department of Finance analysis as to the best use of revenue from the tax. This was despite the committee’s clear instruction that it be included in any analysis, he said.

The lack of any detailed analysis in the 16-page report, Mr Ryan added, gave the appearance that the Department was “trying to kill” this option.

[x_author title=”About the Author”]